Our strategy is designed for tax-paying individuals, primarily high net worth individuals, family offices, and clients of registered investment advisors. As a boutique manager, we build deep client relationships and offer a high-touch experience. We view our investors as partners, not just fund flows. We work to make sure our strategy is the right fit to advance the goals of our clients. The result is a shared mission and alignment of interests.

High Net Worth Individuals

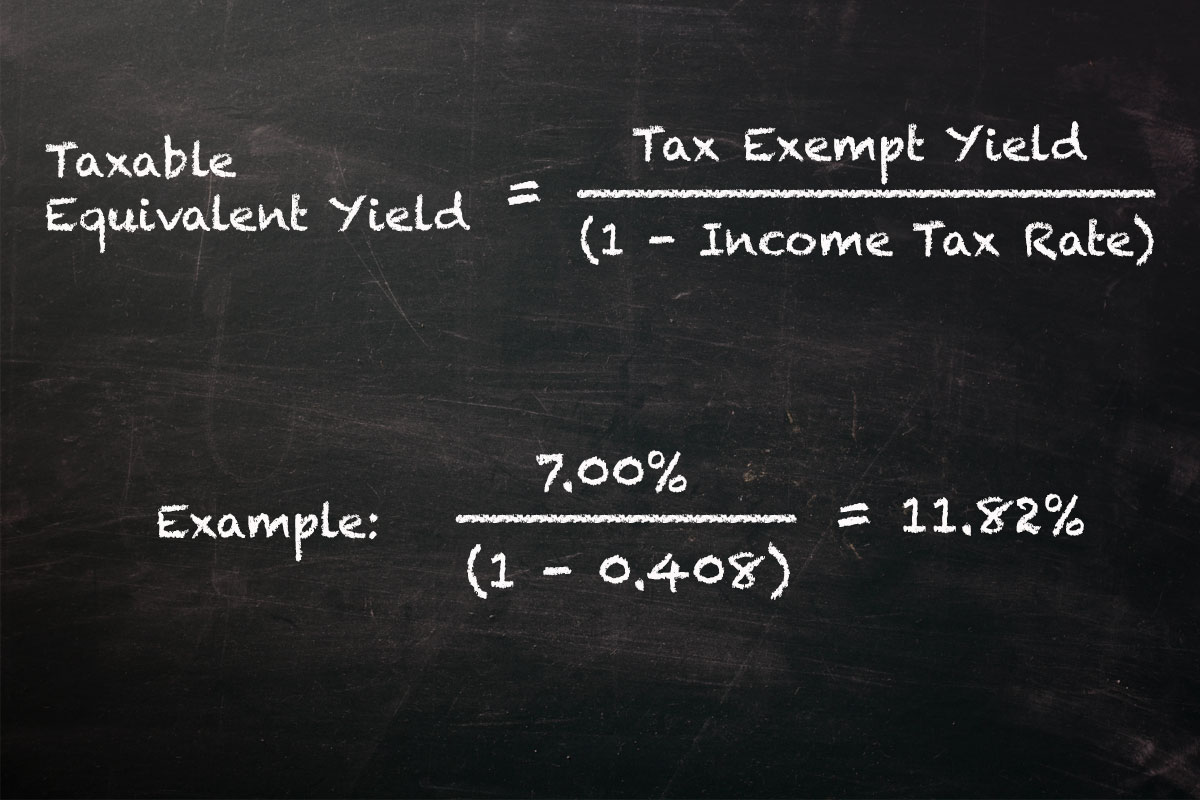

- Individuals in the highest tax bracket capture the largest benefit in “taxable equivalent yield.”

- High levels of tax-exempt income, with flexibility to reinvest or take cash distributions to support lifestyle.

- HNW individuals can access the strategy through the interval fund (LCPMX) or separately managed account (SMA).

Family Offices

- Tax-efficient returns across generational investment goals, whether income or total return focused.

- Interval Fund and SMA vehicles provide flexibility across complex estate planning.

Registered Investment Advisors

- Scalable solution across all client profiles: lower minimum Interval Fund and higher minimum SMA.

- SMAs available on any custodial platform. Interval Fund available on Charles Schwab and Fidelity.

Taxable Equivalent Yield

Because interest payments are exempt from federal income taxes, it is important to consider the “taxable equivalent yield” on municipal bonds. That is, the yield, after taxes, that would be required on a taxable bond to generate the same yield. We estimate this using a formula for Taxable Equivalent Yield.